Introduction

In Malaysia, when is the ideal time to trade forex? As a retail trader, trading the currency market may be quite profitable. The profit potential is enormous, and the currency market offers a variety of chances not found in other sectors. For many years, technology has also been a valuable tool in retail forex trading. Even more so now that it has been adopted, it is transforming the face of many aspects of trade.

New or inexperienced traders may now imitate the trades of pros and develop their accounts without having any prior trading expertise. Traders can use software to look for markets and trade for them using a Forex VPS. Expert Advisors or Forex Robots are two terms for the same thing (EAs).

“What is the ideal time to trade forex in Malaysia?” is one of the most often asked questions, particularly among Malaysian traders.

You’ve probably heard that the market is open 24 hours a day, seven days a week. While this is true, it does not imply that you can or should trade at any given time. When you trade the markets, the time of day you do it can influence whether you earn a profit or not.

As a result, we’ll talk about the optimum time to trade forex in Malaysia in this article. This will assist you in improving your trade.

Forex Market and Availability

The currency market is open 24 hours a day, seven days a week. That is, dealers can trade on each of the five working days of the week for 24 hours (i.e., Monday to Friday). Trading is not restricted to a few hours of the day, unlike many other financial markets such as the stock market. Because the market is open 24 hours a day, traders can trade at any time of day. Many traders can go about their daily lives without altering their trading routine.

Despite the fact that the market is open every day of the week, it does not always work effectively. On the MetaTrader 4 platform, there are indicators that might assist you confirm this. This is due to the fact that market movements can be lethargic at times and vigorous at other times. It can also be very active at times. You may not earn any good gains or maybe lose your funds if you trade during the calm hours. The active moments, on the other hand, are usually the ideal for trading since they provide greater volatility and, as a result, more pips.

Extremely busy times may be risky, as excessive volatility might result in significant losses. Understanding when the market is likely to be quiet, active, or super-active will assist you in determining the optimum time to trade forex in Malaysia.

The Best Time to Trade Forex in Malaysia and the Pairs to Trade

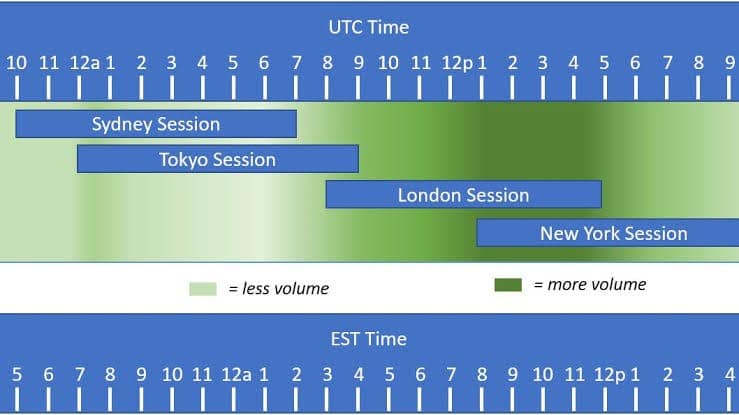

In order to answer this issue, we’ll have to look at a variety of topics, places, and concepts. But we’ll go over them one by one. Then there’s the question of Forex time zones. You’ll be able to trade at the optimal moment if you learn how to deal with time zones. The time zones are depicted in the diagram below.

Investopedia.

There are no rigid regulations governing which Forex time zones and, as a result, trading sessions exist. We’ve taken the time to break down Forex time zones into the following 5 trading sessions since we don’t want you to have any problems on your forex journey:

i ) Sydney

ii) Tokyo

iii) Frankfurt

iv) London

v) New York.

However, you should keep in mind that the timings for each session vary depending on the season. For example, during the Fall/Winter, specific hours are assigned, however throughout the Spring/Summer, the hours tend to shift. The following are some of them:

i) Sydney Session

The Australian session is also known as this. Financial and business operations in Australia and New Zealand pick up during this session (also a big financial center). During the summer and spring, the Australian Session runs from 10 p.m. GMT (6 a.m. Malaysian time) to 7 a.m. GMT (3 p.m. Malaysian time), whereas in the fall and winter, it runs from 9 p.m. GMT (5 a.m. Malaysian time) to 6 a.m. GMT (6 a.m. Malaysian time) (2 PM Malaysian Time).

During this session, the AUD and NZD are the most active currencies. The AUD/USD, NZD/USD, USD/JPY, and minors like the AUD/NZD and AUD/JPY are all popular pairings to trade during this session.

ii) Tokyo Session

The Tokyo session is the most important trading session in Asia. Hong Kong and Singapore, on the other hand, are also open at this hour. The Asian session begins one hour after Sydney’s at 11 p.m. GMT (7 a.m. EST Malaysian time) and concludes at 8 a.m. GMT (4 p.m. Malaysian time) in the summer and spring, and maintains the same in the fall and winter.

When the JPY becomes active, it is during the Asian Session. As a result, the USD/JPY is one of the pairings that moves at this time. At this time, the Sydney/Australian session will also be open. As a result, transactions in currency pairings like AUD/JPY and NZD/JPY tend to be beneficial.

Session in Frankfurt

This session is not considered a stand-alone session, yet it is nevertheless acknowledged in many circles. During Summer/Spring, it opens at 6 a.m. GMT (2 p.m. Malaysian time) and closes at 3 p.m. GMT (11 p.m. Malaysian time); during Fall/Winter, it opens at 7 a.m. GMT (3 p.m. Malaysian time) and closes at 11 p.m. GMT (7 a.m. Malaysian time). Notably, volatility and activity in the Euro begin during this session.

iii) London Session

The London Session, which begins in London, is formally called as the European Session since it heralds the start of real-time financial operations throughout Europe. It runs from 7 a.m. GMT (3 p.m. Malaysian time) to 4 p.m. GMT (midnight Malaysian time), and from 8 a.m. GMT (4 p.m. Malaysian time) to 5 p.m. GMT (midnight Malaysian time) (1 AM Malaysian Time). Those are the finest periods to trade the EUR and GBP, and practically all GBP and EUR pairings are advised.

iv) New York

The official American session, the New York session, begins at noon GMT (8 PM Malaysian Time) and ends at 9 PM (5 AM Malaysian Time); during the Fall/Winter, it runs from 1 PM GMT (9 PM Malaysian Time) to 10 PM GMT (6 AM Malaysian Time). During this session, the USD is most active, and all USD pairings become quite active.

The pairings you trade should be selected by the time of day you like to trade based on those sessions. That is, when it is convenient for you and you have the opportunity to deal. Nonetheless, trading currency pairs at their busiest hours, when they tend to generate the most volatility and deliver the most pips, will assist. Currency pairings do have hours when they are most active, as we described before. Those are the periods when you can make the most money.

As a result, if you want to trade during the day (i.e., during the Australian and Asian sessions), we recommend going with AUD, NZD, HKD, and JPY pairings. If you trade at night (during the European and American sessions), pairs including the USD, GBP, EUR, and CHF, among others, will be ideal.

While the focus is on the ideal time to trade forex in Malaysia, it’s equally important to know when not to trade forex in Malaysia. Avoiding the markets from time to time can help you avoid losses and protect your funds for profit.

The Best Time Not to Trade Forex in Malaysia

Knowing when to stay away from the markets might help you improve your trading and avoid excessive losses. There are two important periods when you should refrain from trading forex in Malaysia. They’ll be mentioned farther down.

Before a Major News Release

Markets are always changing. The foreign currency market is notorious for its extreme volatility, since it may create a large number of pips in a short period of time. However, there are moments when it causes extreme volatility and movement; one of these situations is just before and after major news releases.

When news and events are released, there are both periodic and non-periodic news releases and events that will create large changes in the FX market. These include, for example, the publication of crucial economic information such as the current unemployment rate or central bank interest rate decisions. Other statistics include GDP growth rates and much more. These occur on a regular basis.

When these news items are due to be revealed, it is common sense to avoid trading. Because of the tremendous motions they create, this is the case. Interest rate choices, unemployment rates, and GDP growth rate disclosures are all known to be quite volatile on a regular basis. As a result, stay away from trading at and around certain periods. You may look at FX calendars like Forex Factory to see when they are planned.

However, numbers aren’t the only thing that may be hazardous. The non-periodic ones might be extremely riskier. Is there a primary election in the nation whose currency you want to trade coming up? Then refrain from trading at that moment. The 2016 US Presidential Election, for example, had a tremendous impact on practically all currencies, forcing traders to lose a significant amount of money. This holds true for significant referendums as well. The 2017 Brexit referendum resulted in a lot of volatility in the foreign exchange markets.

The volatility and changes caused by news items usually occur right afterward. You can observe the moments as soon as the news is out. Massive events generally occur in the minutes after major news announcements. However, it is common for volatility to begin even before the news is published, particularly in the final minutes before announcements.

Do not trade during the weekend.

With the exception of the cryptocurrency market, all markets are normally closed on weekends. Many traders, on the other hand, have open positions that they keep open over the weekend and into the next week. This might be for a variety of reasons, such as seeing a great trade setting that they don’t want to miss.

While this isn’t wholly negative, it might be quite hazardous. This is due to a notion known as Gap. A gap is a sudden change in the price of a currency pair with no trading in between. When a gap appears, the pair makes many leaps from its present price at one point to a completely different price at the following point. Gaps appear in the market under a variety of circumstances, including after explosive news releases. It is, nevertheless, quite prevalent on weekends. When Friday trading finishes, the pair normally stops moving at the last price before the closure, and it usually restarts at the same price on Monday. If there are any gaps, the currency pair may continue trading at a different price.

The USDJPY, for example, may close at 110.00 on Friday but begin trading on Monday at 118.50. It could work nicely for you if you’re on a BUY trade. If you’re on a SELL transaction, though, you might lose a lot of money. If it falls inside that range, your Stop Loss may be struck.

What is the best time to trade forex in Malaysia?

There is no definitive solution to this question. When you want to trade forex in Malaysia, the best time to trade is when you want to trade. That is, when it is convenient for you and you have the opportunity to deal. However, as previously said, while there are periods when trading is advantageous, there are also occasions when trading is not advantageous; that is, times when you should avoid the markets. This is due to the risky market movements that occur at certain times. The examples of these have already been mentioned.

Conclusion

Knowing when the markets will move is a valuable ability to have when navigating. This allows you to target your talent at moments when the markets are most likely to generate returns.

Knowing when to stay away from the markets, on the other hand, is a vital talent. This is because it might assist you steer away from markets that are particularly volatile and can lead you to lose money.

As a result, determining the optimum time to trade forex in Malaysia involves combining two factors: when to trade and when to avoid trading.